Hsmb Advisory Llc Can Be Fun For Anyone

Hsmb Advisory Llc Can Be Fun For Anyone

Blog Article

Get This Report on Hsmb Advisory Llc

Table of ContentsFacts About Hsmb Advisory Llc RevealedThe Ultimate Guide To Hsmb Advisory LlcThe Greatest Guide To Hsmb Advisory LlcThe Ultimate Guide To Hsmb Advisory LlcExcitement About Hsmb Advisory Llc

A variant, called indexed global life insurance policy, provides an insurance policy holder the option to divide money value totals up to a fixed account (low-risk investments that will not be impacted by the stock exchange) or an equity indexed account, such as Nasdaq 100 or the S & P 500. https://hsmbadvisory.jimdosite.com/. The insurance policy holder has the option of how much to allot to each accountThese plans are called joint or survivorship life insurance policy and can be either first-to-die or second-to-die plans. A first-to-die joint life insurance coverage policy implies that the life insurance policy is paid out after the first person passes away - Health Insurance St Petersburg, FL. As an example, John and Mary take out a joint first-to-die plan. John passes away prior to Mary does, so the plan pays to Mary and/or various other beneficiaries.

These are generally made use of in estate planning so there suffices cash to pay estate tax obligations and various other expenditures after the fatality of both partners. As an example, let's state John and Mary secured a joint second-to-die plan. So one of them is dead, the policy is still active and doesn't pay out.

Hsmb Advisory Llc Can Be Fun For Everyone

This guarantees your lender is paid the balance of your home loan if you pass away. Reliant life insurance policy is insurance coverage that is provided if a partner or reliant youngster passes away. this website This sort of insurance coverage is normally utilized to off-set costs that happen after fatality, so the amount is usually tiny.

Things about Hsmb Advisory Llc

This kind of insurance coverage is additionally called funeral insurance coverage. While it might seem unusual to take out life insurance for this kind of task, funeralseven easy onescan have a cost tag of numerous thousand bucks by the time all costs are factored in.

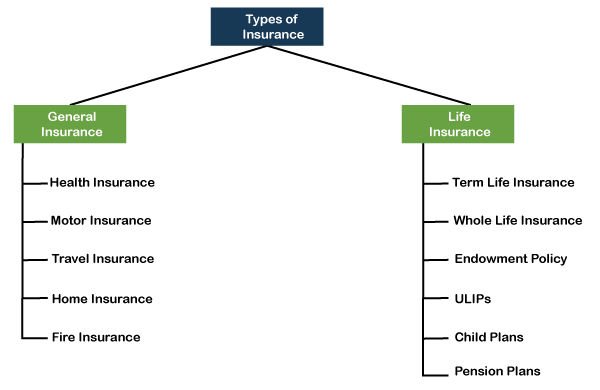

We're below to assist you appear the clutter and discover even more concerning one of the most prominent sort of life insurance policy, so you can decide what's finest for you.

This web page offers a glossary of insurance policy terms and definitions that are frequently made use of in the insurance service. New terms will certainly be included in the glossary with time. The definitions in this glossary are created by the NAIC Research and Actuarial Department team based on various insurance coverage references. These meanings stand for an usual or general usage of the term.

The Best Guide To Hsmb Advisory Llc

- unanticipated injury to an individual. - an insurance coverage contract that pays a stated advantage in the occasion of fatality and/or dismemberment triggered by mishap or specified kinds of crashes. - duration of time insured have to incur qualified clinical costs a minimum of equivalent to the deductible quantity in order to establish an advantage duration under a major medical cost or detailed clinical cost policy.

- insurer assets which can be valued and included on the equilibrium sheet to establish economic practicality of the company. - an insurance company accredited to do business in a state(s), domiciled in a different state or country. - take place when a plan has actually been refined, and the costs has actually been paid before the effective date.

- the social sensation where individuals with a greater than typical likelihood of loss seek greater insurance policy protection than those with much less danger. - a group sustained by member business whose feature is to collect loss stats and publish trended loss prices. - an individual or entity that directly, or indirectly, through one or more various other individuals or entities, controls, is controlled by or is under typical control with the insurance provider.

Getting The Hsmb Advisory Llc To Work

- the maximum buck quantity or total quantity of protection payable for a solitary loss, or multiple losses, throughout a plan period, or on a solitary job. - method of reimbursement of a health insurance with a corporate entity that directly supplies care, where (1) the health insurance is contractually called for to pay the total operating expense of the business entity, much less any kind of income to the entity from various other users of services, and (2) there are common unrestricted assurances of solvency between the entity and the health insurance that put their respective capital and excess at danger in ensuring each other.

- a price quote of the cases settlement associated with a specific case or cases. - an insurance coverage company created according to the legislations of a foreign nation. The company needs to satisfy state regulatory requirements to legitimately offer insurance coverage items because state. - insurance coverages which are normally written with home insurance, e.- an annual report required to be submitted with each state in which an insurer does company. https://moz.com/community/q/user/hsmbadvisory. This report offers a photo of the economic condition of a business and significant occasions which happened throughout the reporting year. - the recipient of an annuity payment, or person during whose life and annuity is payable.

Report this page